Bagley Risk Management Fundamentals Explained

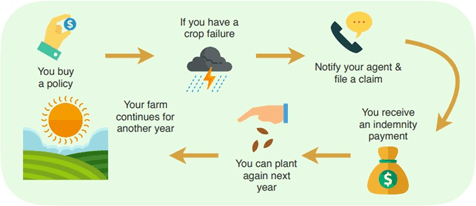

Livestock Danger Security (LRP) is a USDA subsidized insurance program that helps shield manufacturers from the threats that come from market volatility. With LRP, producers have the ability to insure a floor cost for their livestock and are paid an indemnity if the market worth is reduced than the insured rate.

This item is intended for. Livestock insurance.

The smart Trick of Bagley Risk Management That Nobody is Discussing

In the last number of months, several people at FVC and PCM have obtained questions from producers on which danger administration device, LRP vs. Futures, is better for a pork producer? Like many tools, the solution relies on your procedure's goals and circumstance. For this version of the Dr.'s Corner, we will check out the circumstances that tend to favor the LRP device.

In Mike's analysis, he contrasted the LRP computation versus the future's market close for each and every day of the past twenty years! The percentage shared for each and every month of the provided year in the first section of the table is the portion of days because month in which the LRP calculation is reduced than the futures close or in various other words, the LRP would potentially compensate greater than the futures market - https://disqus.com/by/bagleyriskmng/about/. (LRP Insurance)

As an example, in January 2021, all the days of that month had LRP possibly paying greater than the futures market. Conversely, in September 2021, all the days of that month had the futures market potentially paying more than LRP (zero days had LRP less than futures close). The tendency that shows itself from Mike's evaluation is that a SCE of a LRP has a higher possibility of paying a lot more versus futures in the months of December to Might while the futures market has a higher likelihood of paying more in the months of June to November.

Indicators on Bagley Risk Management You Should Know

As an example, in 2019, LRP was better or within a $1. Table 2 illustrates the average basis of the SCE LRP computations versus the future's close for the offered time structures per year.

Again, this information supports extra likelihood of an SCE of a LRP being far better than futures in December via May for the majority of years. As an usual caution with all evaluation, past efficiency is NO guarantee of future performance! It is necessary that producers have accounting protocols in location so they understand their price of production and can better determine when to utilize risk management devices.

The Basic Principles Of Bagley Risk Management

Some on-farm feeders might be considering the demand for price defense currently of year on calves retained with the intent to feed them to a coating weight at some time in 2022, using offered feed sources. Despite solid fed livestock prices in the current regional market, feed expenses and present feeder calf bone worths still create limited feeding margins progressing.

23 per cwt. The existing ordinary public auction price for 500-600 extra pound steers in Nebraska is $176 per cwt. This suggests a break-even price of $127. 57 for the 1,400-pound guide in July of 2022. The June and August live livestock contracts on the CME are currently trading for $135. 58 and $134.

Cattle-feeding business often tend to have limited margins, like lots of farming business, due to the competitive nature of the business. Cattle feeders can bid more for inputs when fed livestock prices increase. https://worldcosplay.net/member/1717216. This increases the rate for feeder cattle, specifically, and somewhat boosts the costs for feed and various other inputs

The 8-Minute Rule for Bagley Risk Management

Nebraska cattle are close to major handling facilities. As an outcome, basis is favorable or absolutely no on fed cattle across much of the state.

Only in 2020 did the LRP protection price go beyond the finishing value by adequate to cover the premium price. The web result of having this LRP insurance coverage in 2019-20 was significant, adding $17.

37 The manufacturer premium decreases at lower insurance coverage levels yet so does the protection cost. The result is a lower net result (indemnity premium), Resources as coverage level declines. This shows reduced efficient levels of defense. Nonetheless, since producer premiums are so reduced at reduced protection degrees, the manufacturer loss proportions (indemnity/premium) increase as the protection degree declines.

Not known Incorrect Statements About Bagley Risk Management

As a whole, a producer needs to take a look at LRP coverage as a device to secure result rate and succeeding revenue margins from a danger administration viewpoint. Some manufacturers make an instance for guaranteeing at the reduced levels of coverage by concentrating on the choice as an investment in risk monitoring security.